That way you split your actual donations across 2 years but you can consolidate your itemized deductions in one year. If you are ever prompted for.

|

| Fidelity Charitable Gift Fund Does A Donor Advised Fund Make Sense For Me The Motley Fool |

Generally a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501 c 3 organization which is called a sponsoring.

. Heres what Chevrons Humankind Matching Gift Program guidelines say about donor-advised funds. Fidelity Charitable offers Fidelity donor-advised funds and Schwab Charitable offers Schwab donor-advised funds. At Fidelity donors must make one gift of at least 50 every three years. These sponsors serve donors nationwide and can distribute.

Fidelity and Schwab currently have 50 minimums while Vanguard requires a 500 minimum. This is beneficial for a number of reasons for me but one of the biggest benefits is avoiding capital gains tax. A donor-advised fund means a public charity operated by a financial services firm which serves as a convenient umbrella for individual or institutional. Fidelity Charitable is the brand name for Fidelity Investments Charitable Gift Fund an independent public charity with a donor-advised fund program.

When you contribute to a donor. The Fairbairns filed the lawsuit in 2018 accusing Fidelity Charitable of mishandling a contribution to their donor-advised fund account of 100 million of stock in late 2017. A donor-advised fund DAF is an investment account that lets you take a tax deduction now and give the money to charity later. It reported more than 31 billion in assets in its fiscal year that ended June 30 2019.

You can use your donor-advised fund to support women and girls and even specify your gift to be used for specific areas of UNFPAs work. If you are ever prompted for additional. Each donor-advised fund sets its own minimum amount for grants to charities. Donor-advised funds must be directly funded by the employee retiree or director only.

Fidelity Investments Charitable Gift Fund is the big kahuna of donor-advised funds. When you give money to a DAF you can. To maximize this benefit I. I recently opened a Donor Advised Fund with Fidelity.

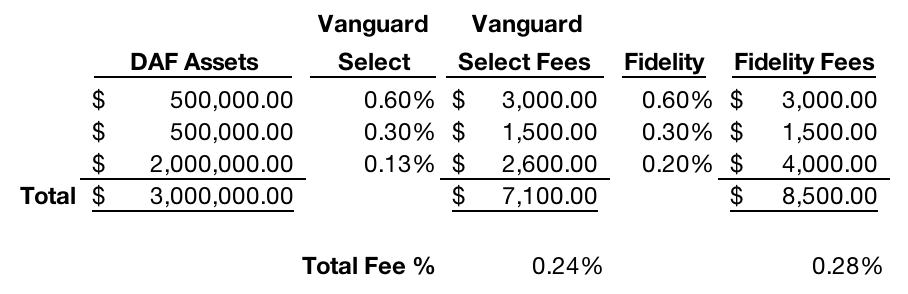

The donor-advised fund is one of the most tax-efficient ways to donate money to charity which has helped it become the fastest-growing charitable giving vehicle in the US. They both charge 06 or 100 year at whichever is greatest for the first. Fidelity declined to provide recent asset figures. For more information please call our Director of.

Fidelity Investments itself received nearly 60 million last year. Last we checked Fidelity Donor-Advised Fund fees are on par with Vanguard Donor-Advised Funds fees. Traditionally donor-advised fund providers make money by charging based on a percentage of assets on accounts leading them to have an unfortunate conflict of interest. Donor-advised funds which make charitable giving quick and easy are increasingly popular.

Donors can make grants in any amount of at least 50. Fidelity Charitable will never ask you for any personal information other than your username and password when logging into your Giving Account. Like all donor-advised funds Fidelity Charitable also comes with an additional layer of administrative costs. In the US.

A DAF is a dedicated charitable fund maintained by a public charity a sponsored organization that is exclusively dedicated to charitable giving. In its summary of 2020 charitable giving. Fidelity does charge a minimum each year 100 I think. Benefits of Donor-Advised Funds DAFs The main benefit of a DAF is the ability to make a donation and take an immediate tax deduction for it while waiting to decide how the.

|

| Giving Account Benefits Fidelity Charitable |

|

| Top 10 Daf Charities By Grants Nptrust |

|

| How To Target Donor Advised Fund Givers For Fundraising Wealthengine |

|

| Donor Advised Funds Soar Amid Stock Surge And Political Changes |

|

| Giving Account Benefits Fidelity Charitable |